How Lots of Little Bets Create a Few Big Wins

Problem Statement

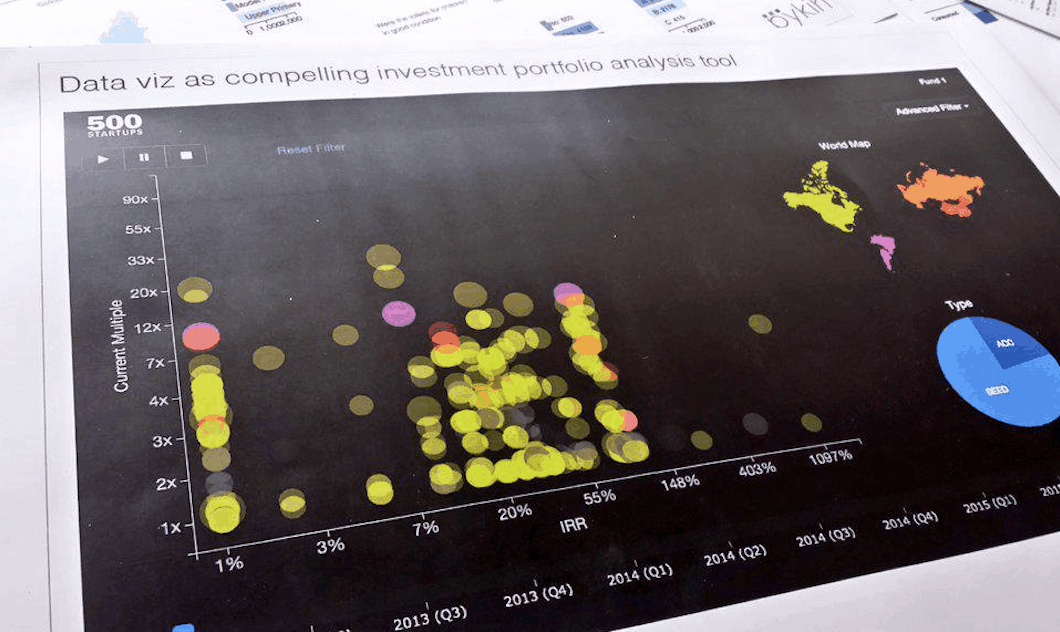

VCs have limited predictability for future success (high variability for outcome returns and high mortality rate). Small number of high value outcomes drive portfolio values. The client wanted a presentation aid to visually drive home this point at their annual investor meeting.

A certain number of investments were made over 16 quarters. ~Half of the investments fall to zero value. ~20% of the investments maintain value of initial investment. Remaining ~30% grow in value. Some of them have outsized 20x or better. Remaining are at 3-5x.

Design

We can take inspiration from the animated scatter chart used by https://www.gapminder.org/world with following axis

- Y-axis: Pure return on initial investment (log scale, range: 1-100x) all initial values start at 1x; most companies fall quickly to zero within 1-2yr

- X-axis: IRR (how quickly did the investment reach a certain return)

- The area of the bubble would communicate company valuation

We added a timeline tool that functioned similar to a video’s “Play” button allowing a user to navigate through company performances across timeframes. This turned out to be a critical storytelling tool for the investment analyst as it depicted how companies grew or went out of business.

We also built a set of interactive filters based on sectors, geography and other company parameters so users could quickly drill down to the category of interest in the discussion.

Outcome

Demo

While we cannot show the demo with 500 startup’s data, we recreated the visual for a story that was published on MoneyControl.com.